News Release

January 21, 2025

Vancouver, British Columbia — (January 21, 2025) – Daura Gold Corp. (formerly Daura Capital Corp.) (TSXV:DGC) (the “Company” or “Daura”) is pleased to announce that it has closed its previously announced qualifying transaction involving the acquisition of Estrella Gold S.A.C. (the “Qualifying Transaction”). Subject to final acceptance by the TSX Venture Exchange (the “TSXV”), the Company will be a Tier 2 Mining issuer focused on the exploration and development of its Cochabamba Project, located in the Ancash Region of north-central Peru.

In conjunction with the closing of the Qualifying Transaction, the Company:

- Completed a non-brokered private placement financing (the “Concurrent Financing”) for aggregate gross proceeds of $1,466,623,

- Settled outstanding indebtedness of the Company totaling $186,184 in a shares-for-debt transaction (the “Debt Settlement”), and

- Changed its name to “Daura Gold Corp.”

Final acceptance by the TSXV of the Qualifying Transaction will occur upon issuance of the TSXV’s final bulletin (the “Final Bulletin”). Subject to issuance of the Final Bulletin, trading in the Company’s common shares is expected to begin on the TSXV under its new name “Daura Gold Corp.” and the trading symbol “DGC.” Trading is expected to commence under the new symbol at the opening of markets on or about January 27, 2025. Shareholders of the Company are not required to take any action with respect to the name change or exchange their existing share certificates for new ones.

Qualifying Transaction

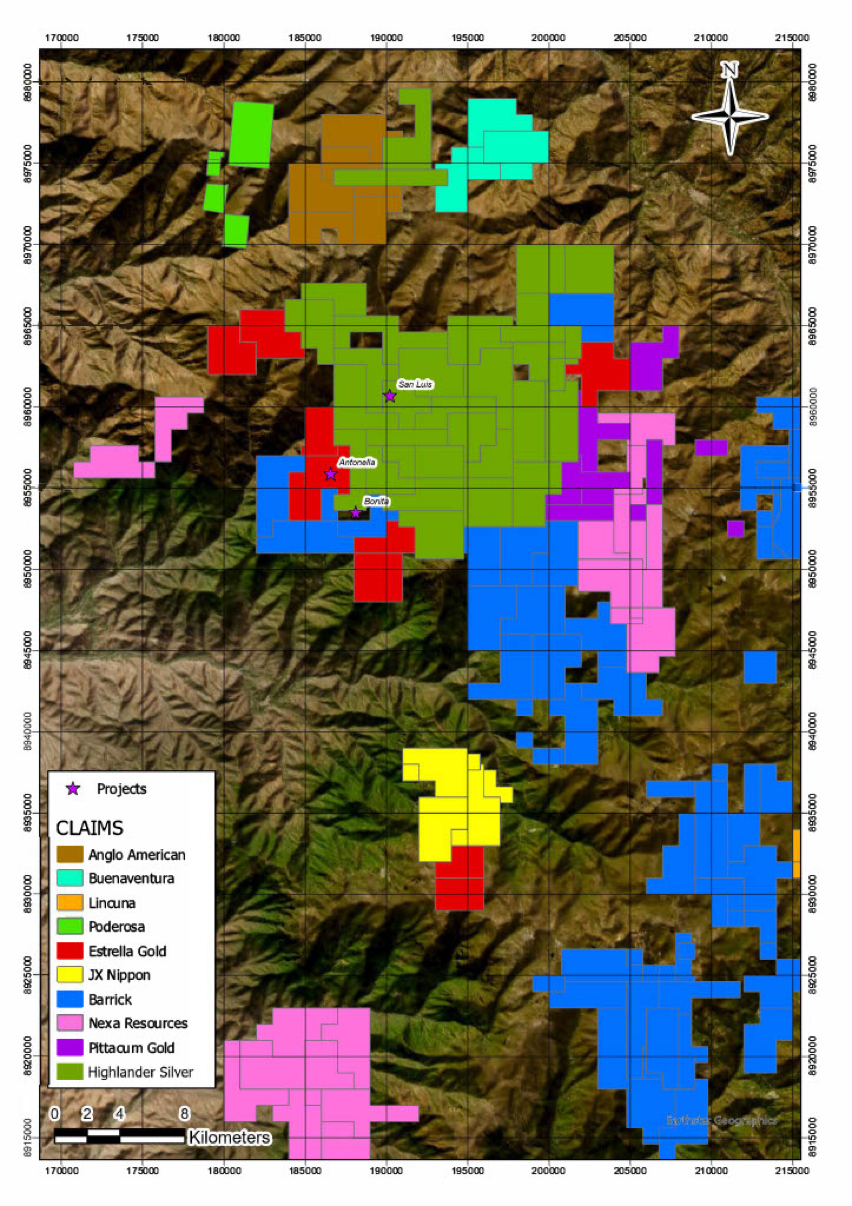

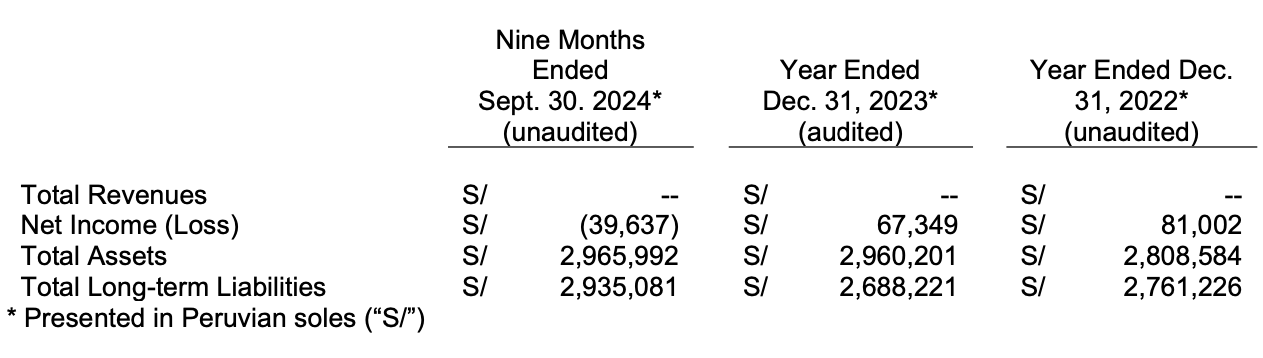

Pursuant to the terms of the share exchange agreement (the “Share Exchange Agreement”) among the Company, Estrella Gold S.A.C. (“Estrella”), and its shareholders, the Company acquired all of the outstanding shares of Estrella for a total consideration of 7,000,000 common shares of Daura. Estrella owns a 100% interest in the mining concessions comprising the Cochabamba Project, located in the Ancash Region of north-central Peru. This includes the Antonella Gold Project, a 900-hectare exploration concession adjacent to the San Luis Gold Project recently acquired by Highlander Silver Corp.

Additional details of the Qualifying Transaction are included in the Company’s filing statement dated December 19, 2024 (the “Filing Statement”), which is available under Daura’s profile on SEDAR+ at www.sedarplus.ca.

Concurrent Financing and Debt Settlement

Concurrent with the Qualifying Transaction, the Company completed a non-brokered private placement of 24,443,732 units (each a “Unit”) at a price of $0.06 per Unit, for total gross proceeds of $1,466,621. Each Unit consisted of one common share and one share purchase warrant (each a “Warrant”). Each Warrant is exercisable for one additional common share at $0.10 per share for two years from the issuance date. Proceeds from the financing will fund exploration of the Cochabamba Project, transaction expenses, and general working capital.

The Company also settled $186,184 of outstanding debt through the issuance of 3,103,066 common shares at $0.06 per share. Of this amount, $123,184 was owed to directors and officers of the Company. No Warrants were issued as part of the Debt Settlement. These transactions qualify as “related party transactions” under TSXV Policy 5.9 and MI 61-101. The Company relied on exemptions for formal valuation and minority approval requirements as the fair market value of the transaction did not exceed 25% of Daura’s market capitalization.

Securities issued in the Concurrent Financing and Debt Settlement are subject to a four-month hold period. The Concurrent Financing was not registered under the United States Securities Act of 1933, and securities may not be sold in the U.S. unless registered or an exemption applies.

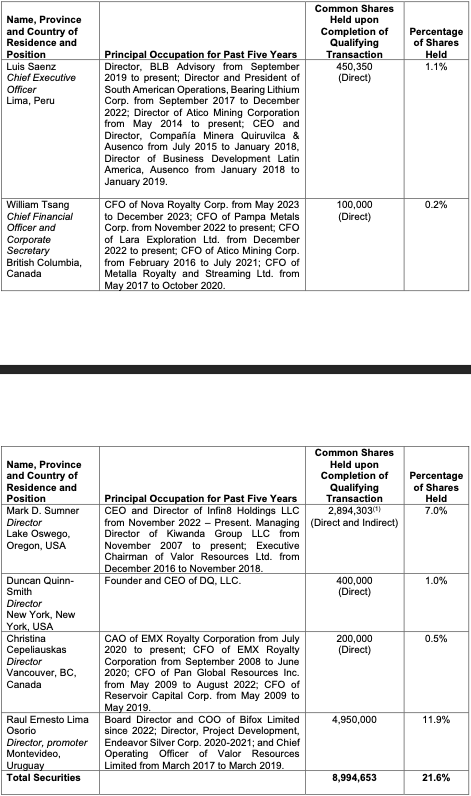

Additional details regarding the directors and officers of the Company are set out in the Filing Statement.

Outstanding Share Capital and Escrow

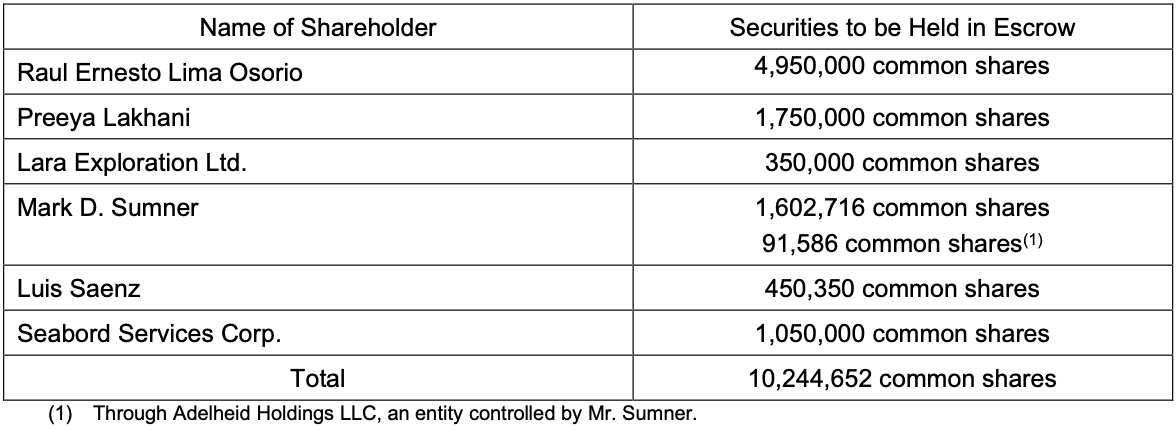

Upon completion of the Qualifying Transaction, the Concurrent Financing and the Debt Settlement, the Company had an aggregate of 41,601,466 common shares issued and outstanding, of which 10,244,652 common shares will be subject to Tier 2 value escrow requirements as follows:

As disclosed in the Company’s Filing Statement, an additional 2,766,668 common shares are subject to CPC escrow requirements.

Early Warning Disclosure

Upon closing of the Qualifying Transaction, Dr. Raul Ernesto Lima Osorio acquired 4,900,000 common shares of the Company in exchange for all his shares of Estrella. The shares acquired by Dr. Lima represent approximately 11.9% of the Company’s outstanding common shares on a non-diluted basis and 7.5% on a fully diluted basis. Prior to the closing, Dr. Lima owned 50,000 common shares of the Company.

Dr. Lima does not currently have plans to acquire additional securities or dispose of his holdings in the Company. However, he may acquire or dispose of securities depending on market conditions, changes in plans, or other relevant factors.

This disclosure is being made pursuant to National Instrument 62-103 - The Early Warning System and Related Take-Over Bid and Insider Reporting. Copies of the early warning reports will be available on the Company's profile on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com and can also be obtained by contacting the Company at the details provided below.

About Daura Gold Corp.

Daura Gold Corp. is a mineral resource company focused on the acquisition, exploration, and development of metals and mineral deposits in South America. The Company’s current exploration efforts are focused on the Cochabamba Project, a prospective gold, silver, and copper property covering 10,000 hectares in the Ancash region of north-central Peru.

For Further Information, Please Contact:

Daura Gold Corp.

543 Granville, Suite 501

Vancouver, BC V6C 1X8

William T.P. Tsang

CFO and Secretary

(604) 669-0660

btsang@seabordservices.com

Mark D. Sumner

CEO and Director

mark@kiwandagroup.com

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking statements that reflect management's current estimates, beliefs, intentions, and expectations. These statements are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond its control.

Such factors include, but are not limited to: future prices and the supply of gold and other metals; future demand for precious and base metals; the inability to raise necessary funding for property retention and advancement; known and unknown environmental liabilities; general business, economic, competitive, political, and social uncertainties; results of exploration programs; risks associated with mineral exploration; delays in obtaining governmental approvals; and failure to obtain necessary regulatory or shareholder approvals.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events may differ materially from those anticipated. Readers are cautioned not to place undue reliance on forward-looking statements. Daura disclaims any obligation to update or revise forward-looking statements, whether due to new information, future events, or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. THE TSX VENTURE EXCHANGE HAS IN NO WAY PASSED UPON THE MERITS OF THE PROPOSED TRANSACTION AND HAS NEITHER APPROVED NOR DISAPPROVED THE CONTENTS OF THIS PRESS RELEASE.

share this

Other Recent Daura Gold News Releases.

Stay Updated With Daura Gold.

We will get back to you as soon as possible.

Please try again later.

Sign up for our newsletter to receive news releases and exclusive company updates.