News Releases.

Stay informed with the latest news and updates from Daura Gold Corp. (TSXV: DGC)

February 21, 2025

Vancouver, British Columbia — (February 21, 2025) – Daura Gold Corp. (formerly Daura Capital Corp.) (TSXV:DGC) (the “ Company ” or “ Daura ”) is announcing a correction to its news release regarding the settlement of outstanding indebtedness for securities of the Company. The Company’s news release dated February 19, 2025 incorrectly stated the unit price and warrant exercise price for the units issued in settlement of $101,200 in outstanding indebtedness owed to an arms-length third party. Pursuant to the polices of the TSX Venture Exchange (the “TSXV”), in settlement of the indebtedness, the Company will issue an aggregate of 1,124,444 units (each a “Unit”) at a price of $0.09 per Unit. Each Unit will consist of one common share of the Company and one warrant exercisable at a price of $0.115 per share for a period of two years from the date of issuance. Closing remains subject to the approval of the TSX Venture Exchange. The securities to be issued pursuant to the Debt Settlement will be subject to a hold period of four months and one day following the date of issuance, in accordance with applicable securities laws and TSXV policies.

February 19, 2025

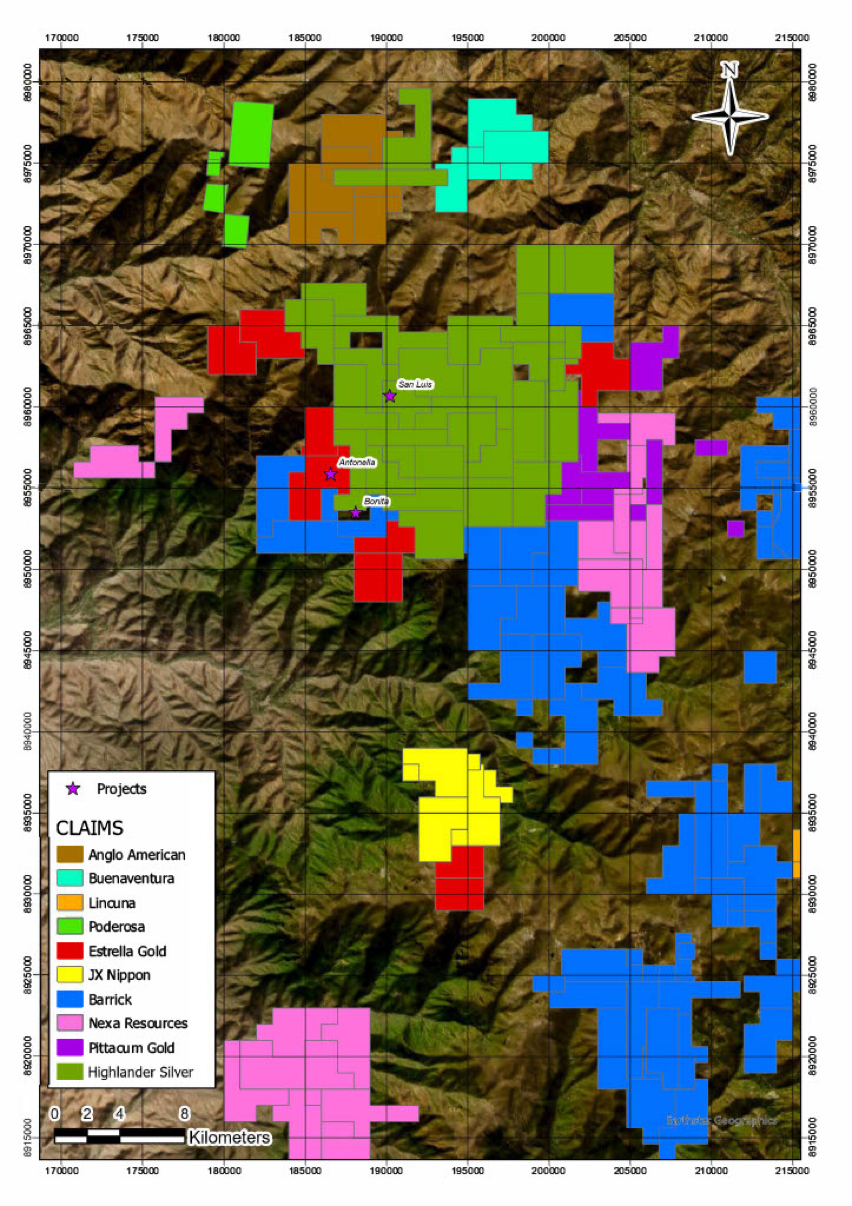

Vancouver, British Columbia — (February 19th, 2025) – Daura Gold Corp. (formerly Daura Capital Corp.) (TSXV:DGC) (the “ Company ” or “ Daura ”) is pleased to provide an operational update on the progress of its planned exploration efforts for its mineral properties located in the Ancash region of Peru. In addition, the Company announces that it has entered into a debt settlement agreement to settle outstanding indebtedness owed to an arms-length third party, and has engaged the services of third party investor relations providers. Operational Update During the challenging period of the Covid-19 shutdown, thanks to the unwavering support of our founding investors, the Company successfully maintained its key properties and kept open lines of communication with stakeholders within the communities. In this timeframe, Daura worked with Estrella to finalize payments on the flagship Antonella property, reinforcing the Company’s commitment to consolidating its presence within the district. Completing this acquisition came at a pivotal moment, as the district has since garnered increased attention from both junior and major mining companies. Over the past few months, the team has been diligently engaged in updating the geological models and preparing for essential fieldwork in the coming months. Daura has prioritized establishing strong relationships with various stakeholders in the community, fostering dialogue with local companies within the district. Engaging with communities affected by the Company’s projects is a crucial next step that will pave the way for exploration activities on Daura’s properties. Daura has also engaged with the various other mining companies in the district who also plan on doing extensive work in the region. Please see figure 1 for land package and other major mining companies who are operating in the region. The Company’s technical team is set to initiate a comprehensive mapping and sampling campaign across its extensive 8,100-hectare land package. The program will commence with targeted areas around the Antonella site to follow up on the previous 2,461 meter drill campaign which delivered high grade intercepts, including: CBD11007: 0.85m @ 8.73 g/t Au CBD11004B: 1.2m @ 8.69 g/t Au CBD11001: 0.20m @ 47.2 g/t Au The primary goal of the initial fieldwork is to confirm drilling targets for the forthcoming exploration campaign. This initiative will also facilitate the preparation and submission of the Company’s drilling permit application. Daura remains committed to consolidating its position in the district and exploring growth opportunities in the region. The Company is dedicated to leveraging its local presence and established relationships while being mindful of the limited capital available. As such, the Company will prioritize, optimize, and deliver results that serve the best interests of its shareholders. Luis Saenz, CEO of Daura, stated: “It is an exciting time to be in the district that hosts the well-known San Luis project, now in the hands of Highlander Silver. The entire region is of interest not only for the historical gold and silver production and prospectivity, but also indications of copper discoveries that have interested some of the majors to the area. Our small but dedicated team has worked for several years to put this package in place and maintain it, and we look forward to beginning work in earnest to create value for our shareholders. We look forward to providing news on our progress in various fronts in the coming weeks." Figure 1. below represents Daura’s land package and the surrounding major mining companies who are also active in the region.

January 21, 2025

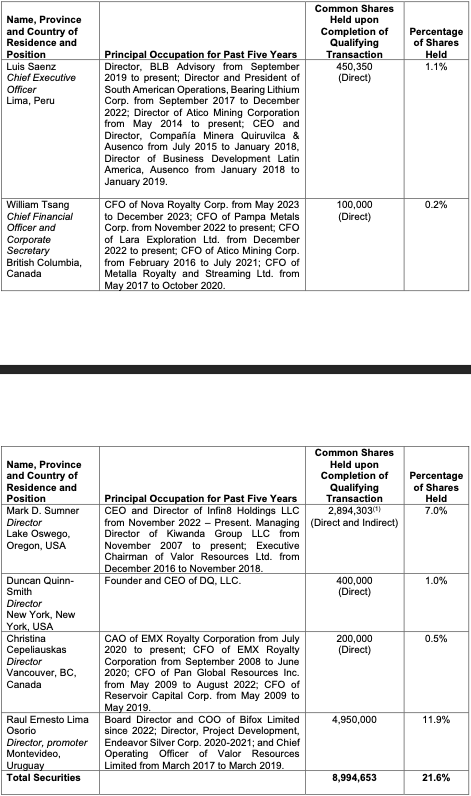

Vancouver, British Columbia — (January 21, 2025) – Daura Gold Corp. (formerly Daura Capital Corp.) (TSXV:DGC) (the “Company” or “Daura”) is pleased to announce that it has closed its previously announced qualifying transaction involving the acquisition of Estrella Gold S.A.C. (the “Qualifying Transaction”). Subject to final acceptance by the TSX Venture Exchange (the “TSXV”), the Company will be a Tier 2 Mining issuer focused on the exploration and development of its Cochabamba Project, located in the Ancash Region of north-central Peru. In conjunction with the closing of the Qualifying Transaction, the Company: Completed a non-brokered private placement financing (the “Concurrent Financing”) for aggregate gross proceeds of $1,466,623, Settled outstanding indebtedness of the Company totaling $186,184 in a shares-for-debt transaction (the “Debt Settlement”), and Changed its name to “Daura Gold Corp.” Final acceptance by the TSXV of the Qualifying Transaction will occur upon issuance of the TSXV’s final bulletin (the “Final Bulletin”). Subject to issuance of the Final Bulletin, trading in the Company’s common shares is expected to begin on the TSXV under its new name “Daura Gold Corp.” and the trading symbol “DGC.” Trading is expected to commence under the new symbol at the opening of markets on or about January 27, 2025. Shareholders of the Company are not required to take any action with respect to the name change or exchange their existing share certificates for new ones. Qualifying Transaction Pursuant to the terms of the share exchange agreement (the “Share Exchange Agreement”) among the Company, Estrella Gold S.A.C. (“Estrella”), and its shareholders, the Company acquired all of the outstanding shares of Estrella for a total consideration of 7,000,000 common shares of Daura. Estrella owns a 100% interest in the mining concessions comprising the Cochabamba Project, located in the Ancash Region of north-central Peru. This includes the Antonella Gold Project, a 900-hectare exploration concession adjacent to the San Luis Gold Project recently acquired by Highlander Silver Corp. Additional details of the Qualifying Transaction are included in the Company’s filing statement dated December 19, 2024 (the “Filing Statement”), which is available under Daura’s profile on SEDAR+ at www.sedarplus.ca . Concurrent Financing and Debt Settlement Concurrent with the Qualifying Transaction, the Company completed a non-brokered private placement of 24,443,732 units (each a “Unit”) at a price of $0.06 per Unit, for total gross proceeds of $1,466,621. Each Unit consisted of one common share and one share purchase warrant (each a “Warrant”). Each Warrant is exercisable for one additional common share at $0.10 per share for two years from the issuance date. Proceeds from the financing will fund exploration of the Cochabamba Project, transaction expenses, and general working capital. The Company also settled $186,184 of outstanding debt through the issuance of 3,103,066 common shares at $0.06 per share. Of this amount, $123,184 was owed to directors and officers of the Company. No Warrants were issued as part of the Debt Settlement. These transactions qualify as “related party transactions” under TSXV Policy 5.9 and MI 61-101. The Company relied on exemptions for formal valuation and minority approval requirements as the fair market value of the transaction did not exceed 25% of Daura’s market capitalization. Securities issued in the Concurrent Financing and Debt Settlement are subject to a four-month hold period. The Concurrent Financing was not registered under the United States Securities Act of 1933, and securities may not be sold in the U.S. unless registered or an exemption applies.

December 23, 2024

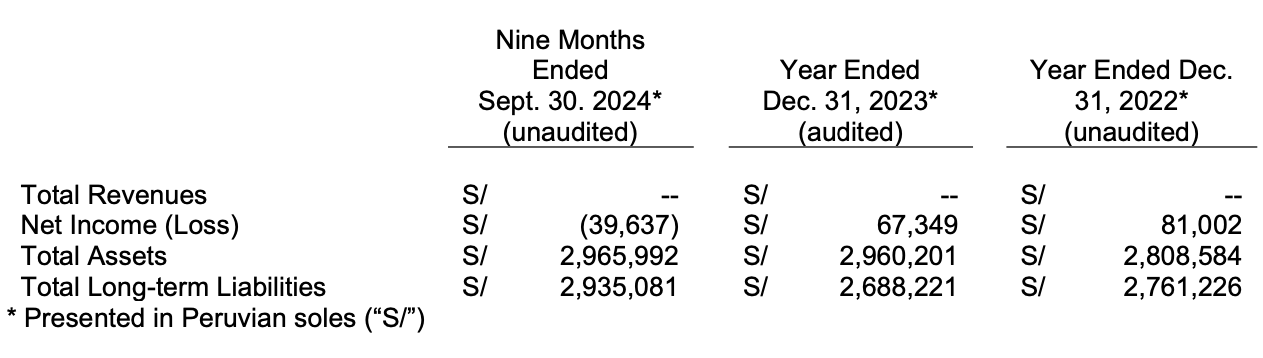

Vancouver, British Columbia — (December 23, 2024) – Daura Capital Corp. (TSXV:DUR.P) (the “Company” or “Daura”), a capital pool company, announced that it has received conditional acceptance from the TSX Venture Exchange (the “TSXV”) for the closing of its proposed acquisition of Estrella Gold S.A.C. (“Estrella”), which transaction is intended to constitute Daura’s Qualifying Transaction (within the meaning of Policy 2.4 – Capital Pool Companies of the TSXV). Daura has filed a filing statement dated effective December 19, 2024 (the “Filing Statement”), including a 43-101 Technical Report on Estrella’s Cochabamba Project with the TSXV and under Daura’s profile on SEDAR+ at www.sedarplus.ca, which describes the Qualifying Transaction. In addition, Daura announced that it has increased the minimum amount of its previously announced concurrent financing (the “Concurrent Financing”) to be completed in connection with its proposed qualifying transaction (the "Qualifying Transaction") to acquire Estrella Gold S.A.C. (“Estrella”). Daura is also providing updated financial information for Estrella. As previously announced, Daura has entered into a definitive agreement to acquire all of the outstanding shares of Estrella from its shareholders (the "Estrella Shareholders") in consideration for 7,000,000 common shares of Daura. For additional information regarding the Qualifying Transaction, please refer to Daura’s news releases dated July 16, 2024, and July 23, 2024. Increase in Minimum Amount of Concurrent Financing The Company has increased the minimum amount of the Concurrent Financing in order to increase the funds available to the Company upon completion of the Qualifying Transaction. Under the Concurrent Financing, the Company intends to issue a minimum of 20,333,334 units (each a “Unit”) and a maximum of up to 25,000,000 Units at a price of $0.06 per Unit for gross proceeds of between $1,250,000 and $1,500,000. Each Unit will consist of one Daura Share and one (full) share purchase warrant (each a “Warrant”), with each whole Warrant entitling the holder to purchase one additional Daura Share at a price of $0.10 per share for a period of two years from the date of issuance. Net proceeds from the Concurrent Financing will be used to fund exploration of the Estrella project portfolio, expenses related to the Qualifying Transaction, and for general working capital purposes. Subject to the approval of the TSXV, Daura may pay eligible finders a fee equal to 7% of the Concurrent Financing in cash, and 7% in share purchase warrants under the QT Financing. All securities issued under the Concurrent Financing will be subject to hold periods expiring four months and one day after the date of issuance. Additional restrictions may apply under the rules of the TSXV and applicable securities laws. This news release does not constitute an offer to sell, or solicitation of an offer to buy, nor will there be any sale of any of the securities offered in any jurisdiction where such offer, solicitation, or sale would be unlawful, including the United States of America. The securities being offered as part of the Concurrent Financing have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and accordingly may not be offered or sold in the United States except in compliance with the registration requirements of the U.S. Securities Act and any applicable state securities laws, or pursuant to available exemptions therefrom. Closing of the Concurrent Financing remains subject to final acceptance by the TSXV. Updated Financial Information for Estrella In addition to the information previously provided in the Company’s news release of July 23, 2024, the Company is providing updated financial information regarding the financial condition and results of operation for Estrella. The following is derived from Estrella’s financial statements for the years ended December 31, 2023 (audited) and 2022 (unaudited) and the interim periods ended September 30, 2024. The following information should be read in conjunction with Estrella’s audited and unaudited financial statements for the periods presented, which financial statements will be included in the filing statement to be filed by Daura on SEDAR in connection with the Qualifying Transaction.

July 23, 2024

Vancouver, British Columbia--(Newsfile Corp. - July 23, 2024) - Daura Capital Corp. (TSXV: DUR.P) (the " Company " or " Daura "), a capital pool company under the policies of the TSX Venture Exchange (the " TSXV "), is pleased to provide an update on the status of its proposed qualifying transaction (the " Qualifying Transaction ") to acquire Estrella Gold S.A.C. (" Estrella "). As previously announced, Daura has entered into a definitive agreement to acquire all of the outstanding shares of Estrella from its shareholders (the " Estrella Shareholders ") in consideration for 7,000,000 common shares of Daura. In addition, Daura has made its initial filings with the TSXV to seek conditional acceptance of the proposed Qualifying Transaction. Daura is continuing to work diligently towards the completion of the proposed Qualifying Transaction under the policies of the TSXV. About Estrella Gold S.A.C. and the Cochabamba Project Estrella is a closely held corporation (S.A.C.) formed under the laws of Peru, engaged in the acquisition and exploration of mineral resource properties. Estrella was formed in August 2018 for the purpose of engaging in the business of acquiring, exploring and developing mineral resource properties. Estrella's principal focus to date has been on the acquisition of the mining concessions and applications making up the Cochabamba Project . The Cochabamba Project consists of 10 mining concessions covering an effective area of 7,223.87 Ha, located on the western flank of the Cordillera Negra, in north central Peru. Included in the Cochabamba Project mining concessions that Estrella owns is the Antonella Daniela I Concession. The Antonella Daniela I Concession covers an area of 900Ha and is currently the main area of interest on the Cochabamba Project. The mineralized veins of the old Esperanza mine form the current main area of interest and were the focus of the bulk of previous exploration activity. The mine is centered at 187,000mE 8,956,000mN and at an altitude of 3700 meters above sea level, and lies entirely within the Antonella Daniela I Concession. Politically the project is located within the Rural Community/Districts Cochabamba, Cacchan, Ecash and Colcabamba, in the Province of Huaraz, Department of Ancash. The Cochabamba Project is an exploration stage project prospective for gold, silver, copper, lead and zinc. To read the rest of this news release please visit: https://www.newsfilecorp.com/release/217533/Daura-Capital-Corp.-Provides-Update-on-Proposed-Qualifying-Transaction

Daura Capital Corp. Enters into Definitive Agreement for Previously Announced Qualifying Transaction

July 16, 2024

Vancouver, British Columbia--(Newsfile Corp. - July 16, 2024) - Daura Capital Corp. (TSXV: DUR.P) (the " Company " or " Daura "), a "capital pool company" under the policies of the TSX Venture Exchange (the " Exchange "), is pleased to announce it has entered into a definitive share exchange agreement (the " Share Exchange Agreement ") in respect of its previously announced "qualifying transaction" under the policies of the Exchange the (" Qualifying Transactio n") to acquire Estrella Gold S.A.C. (" Estrella "). Pursuant to the terms of the Share Exchange Agreement, the Company will acquire all of the outstanding shares of Estrella in consideration for 7,000,000 common shares in the capital of the Company. No finders' fees or commissions will be paid in connection with the Qualifying Transaction. Estrella currently holds a 100% interest in 10 exploration concessions covering 7,230 hectares, including a 100% interest in the Antonella Gold Project, a 900-hectare exploration concession. The Estrella concessions are located in the Cordillera Negra of north-central Perú, 513 kilometers north-northwest of Lima and 113 kilometers east of the city of Casma. Antonella is adjacent to the San Luis gold project, which was recently acquired by Highlander Gold. Highlander has stated they believe San Luis is the highest grade, undeveloped gold project in the world. Daura believes Antonella has potential to become a critical component of this underexplored gold district. The Qualifying Transaction is not a Non-Arm's Length Qualifying Transaction as defined under the policies of the Exchange, and approval from the shareholders of Daura is not expected to be required. The completion of the proposed Qualifying Transaction is subject to the satisfaction of various conditions as are standard for a transaction of this nature, including but not limited to (i) receipt of conditional approval from the TSXV; (ii) receipt of all requisite corporate, and shareholder consents and approvals; and (iii) the completion of the Company's previously announced Concurrent Financing, as more described below. Concurrent Financing In connection with the proposed Qualifying Transaction, as previously announced, the Company will seek to complete a concurrent non-brokered private placement offering (the " Concurrent Financing ") of a minimum of 16,666,667 units (each a "Unit") and a maximum of up to 25,000,000 Units at a price of $0.06 per Unit for gross proceeds of between $1,000,000 and $1,500,000. Each Unit will consist of one common share in the capital of the Company (a "Daura Share") and one (full) share purchase warrant (each a "Warrant"), with each whole Warrant entitling the holder to purchase one additional Daura Share at a price of $0.10 per share for a period of two years from the date of issuance. Net proceeds from the Concurrent Financing will be used to fund exploration of the Estrella project portfolio (further details of which are to be provided), expenses related to the Qualifying Transaction and for general working capital purposes. This news release does not constitute an offer to sell, or solicitation of an offer to buy, nor will there be any sale of any of the securities offered in any jurisdiction where such offer, solicitation or sale would be unlawful, including the United States of America. The securities being offered as part of the QT Financing have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the " U.S. Securities Act "), or any state securities laws, and accordingly may not be offered or sold in the United States except in compliance with the registration requirements of the U.S. Securities Act and any applicable state securities laws, or pursuant to available exemptions therefrom. Additional Information In accordance with the policies of the Exchange, the Daura Shares are currently halted from trading and will remain halted until further notice. Daura and Estrella will provide further details in respect of the Qualifying Transaction, in due course once available, by way of press releases. All information provided in this press release related to Estrella has been provided by management of Estrella and has not been independently verified by management of Daura. Further updates in respect of the Qualifying Transaction and Concurrent Financing will be provided in subsequent press releases and the Filing Statement to be filed by Daura in connection with the Qualifying Transaction, including, information relating to Estrella's properties, sponsorship, summary financial information in respect of Daura and Estrella, and additional information with respect to the Daura Financing. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative. For further information please contact: Daura Capital Corp. 543 Granville, Suite 501 Vancouver BC V6C 1X8 William T.P. Tsang CFO and Secretary (604) 669-0660 btsang@seabordservices.com Mark D. Sumner CEO and Director mark@kiwandagroup.com NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: risks and uncertainties relating to Daura's ability to complete the proposed Qualifying Transaction; and other risks and uncertainties. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Daura undertakes no obligation to publicly update or revise forward-looking information. Completion of the Qualifying Transaction and the Concurrent Financing is subject to conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange Requirements, majority of the minority shareholder approval. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative. The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release. A halt in trading shall remain in place until after the Qualifying Transaction is completed or such time that acceptable documentation is filed with the TSX Venture Exchange.

May 14, 2024

Vancouver, British Columbia — (May 14, 2024) – Daura Capital Corp. (TSXV:DUR.P) (the “Company” or “Daura”), a capital pool company under the policies of the TSX Venture Exchange (the “TSXV”), is pleased to announce a non-brokered private placement to be completed concurrent with the Company’s previously announced proposed Qualifying Transaction (the “Concurrent Financing”). The Qualifying Transaction involves the acquisition of Estrella Gold S.A.C. (“Estrella”), as detailed in the Company’s news release dated May 6, 2024. Concurrent Financing Pursuant to the Concurrent Financing, the Company intends to issue a minimum of 16,666,667 units (each a “Unit”) and a maximum of up to 25,000,000 Units at a price of $0.06 per Unit for gross proceeds of between $1,000,000 and $1,500,000. Each Unit will consist of one common share in the capital of the Company (a "Daura Share") and one (full) share purchase warrant (each a “Warrant”). Each Warrant will entitle the holder to purchase one additional Daura Share at a price of $0.10 per share for a period of two years from the date of issuance. Net proceeds from the Concurrent Financing will be used to fund exploration of the Estrella project portfolio (further details of which are to be provided), expenses related to the Qualifying Transaction, and for general working capital purposes. Subject to TSXV approval, Daura may pay eligible finders a fee equal to 7% of the Concurrent Financing in cash and 7% in share purchase warrants ("Compensation Warrants") having the same terms and conditions as the Warrants. All securities issued under the Concurrent Financing will be subject to hold periods expiring four months and one day after the date of issuance. Additional restrictions may apply under the rules of the TSXV and applicable securities laws. This news release does not constitute an offer to sell, or solicitation of an offer to buy, nor will there be any sale of any securities offered in any jurisdiction where such offer, solicitation, or sale would be unlawful, including the United States. The securities offered as part of the Concurrent Financing have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and accordingly may not be offered or sold in the United States unless in compliance with the registration requirements of the U.S. Securities Act or pursuant to applicable exemptions. Closing of the Concurrent Financing is subject to TSXV approval. Additional Information In accordance with TSXV policies, Daura Shares are currently halted from trading and will remain halted until further notice. Daura and Estrella will provide further details regarding the Qualifying Transaction in due course by way of press releases. All information provided in this press release related to Estrella has been provided by management of Estrella and has not been independently verified by Daura’s management. If and when a definitive agreement between Daura and Estrella is executed, Daura will issue a subsequent press release containing details of the definitive agreement and additional terms of the Qualifying Transaction. These details will include information on Estrella’s properties, sponsorship, summary financial information, the names and backgrounds of all persons expected to be principals and insiders of the resulting issuer, and additional information about the Concurrent Financing. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative. For Further Information, Please Contact: Daura Capital Corp. 543 Granville, Suite 501 Vancouver, BC V6C 1X8 William T.P. Tsang CFO and Secretary (604) 669-0660 btsang@seabordservices.com Mark D. Sumner CEO and Director mark@kiwandagroup.com Cautionary Statement Regarding Forward-Looking Information This news release contains forward-looking statements that reflect management's current estimates, beliefs, intentions, and expectations. These statements are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, but are not limited to: risks and uncertainties related to Daura's ability to complete the proposed Qualifying Transaction; future prices and supply of gold and other metals; environmental liabilities (known and unknown); general business, economic, and competitive uncertainties; and results of exploration programs. In addition, mineralization on adjacent properties may not be indicative of the mineralization found on properties owned by the target of the proposed Qualifying Transaction. Accordingly, actual results and future events may differ materially from those anticipated in forward-looking statements. Daura disclaims any obligation to publicly update or revise any forward-looking information, except as required by law. NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. THE TSX VENTURE EXCHANGE HAS IN NO WAY PASSED UPON THE MERITS OF THE PROPOSED TRANSACTION AND HAS NEITHER APPROVED NOR DISAPPROVED THE CONTENTS OF THIS PRESS RELEASE.

May 6, 2024

Vancouver, British Columbia — (May 6, 2024) – Daura Capital Corp. (TSXV:DUR.P) (the “Company” or “Daura”) is pleased to announce it has entered into a new letter of intent (the “LOI”) with Estrella Gold S.A.C (“Estrella”), a privately held Peruvian gold company, pursuant to which Daura proposes to acquire a 100% interest in Estrella. Estrella holds a series of gold concessions in the Ancash Region of Northern Peru. Estrella’s primary target is a high-grade gold-silver project called Antonella. The Antonella concession was previously owned by Minera Silex Peru SRL, which conducted drilling and sampling on 11 holes located on the Antonella Concession. Antonella is adjacent to the San Luis gold-silver project, recently acquired by Highlander Silver Corp. (CSE:HSLV). Daura is a "capital pool company" under the policies of the TSX Venture Exchange (the "Exchange"). It is intended that the acquisition of Estrella will constitute Daura’s "qualifying transaction" under the policies of the Exchange (the "Qualifying Transaction"). Upon completion of the Qualifying Transaction, the resulting entity (the "Resulting Issuer") is expected to be a Tier 2 Mining issuer under the policies of the Exchange. It is expected that the Qualifying Transaction will not constitute a Non-Arms Length Qualifying Transaction as defined under the policies of the Exchange, and approval from the shareholders of Daura is not expected to be required. The Qualifying Transaction The LOI was signed by the parties on May 1, 2024, and sets out certain non-binding understandings and binding agreements between Daura and Estrella. The LOI constitutes an agreement in principle with respect to the Qualifying Transaction pursuant to the policies of the Exchange. Pursuant to the terms of the LOI, it is expected that Daura and Estrella will negotiate and enter into a definitive agreement incorporating the principal terms of the LOI. Subject to any Exchange, regulatory, or other approvals that may be required, the completion of satisfactory due diligence by Daura and Estrella, the completion of the Daura Financing (as described below), and the satisfaction of other conditions contained in the LOI, it is currently anticipated that Daura will issue a total of 7,000,000 common shares (“Daura Shares”) at a deemed price of $0.06 per share to acquire Estrella. No finder’s fees or commissions are expected to be paid in relation to the Qualifying Transaction. No loans or advances are expected to be made to Estrella in connection with the Qualifying Transaction. However, Estrella is currently indebted to Daura in the principal amounts of $75,000 and US$115,000, which funds were advanced by Daura to Estrella in connection with Daura’s previous attempt to acquire Estrella in 2021 and 2022, which transaction was terminated by mutual agreement of the parties. Estrella currently holds a 100% interest in 10 exploration concessions covering 6,900 hectares and a 100% interest in the Antonella Gold Project, a 900-hectare exploration concession. The Estrella Gold tenements, along with Antonella, are located in the Cordillera Negra of north-central Perú, 513 kilometers north-northwest of Lima and 113 kilometers east of the city of Casma. Antonella is adjacent to the San Luis gold project, which was recently acquired by Highlander Gold. Highlander has stated they believe San Luis is the highest grade, undeveloped gold project in the world. Daura believes Antonella has potential to become a critical component of this underexplored gold district. Upon completion of the Qualifying Transaction, the resulting entity (the “Resulting Issuer”) will be engaged in the business of mineral exploration and development of the Estrella concessions and Antonella Gold Project. In addition, the Resulting Issuer may explore and develop such other properties and interests as may be subsequently acquired by the Resulting Issuer. Upon completion of the Qualifying Transaction, it is currently anticipated that Daura’s existing directors and officers will remain with the Resulting Issuer, and Dr. Ernesto Lima Osorio, the majority shareholder of Estrella, is expected to join the board of directors of the Resulting Issuer. Dr. Ernesto Lima Osorio (Director) is the majority shareholder of Estrella. Dr. Lima has over 25 years of experience in the mining and exploration business across South America. Dr. Lima has been responsible for numerous mining development and construction projects throughout Uruguay, Brazil, Chile, Venezuela, Argentina, and Peru. Dr. Lima’s notable engineering and construction experience in South America includes engineering and development of the San Gregorio gold mine in Uruguay for Rea Gold Corporation, construction and engineering of the $450 million Pirquitas open-pit silver mine in Argentina for Silver Standard Resources, and engineering and construction of the Tucano Gold-Iron Mining Project in Brazil for Beadell Resources Ltd. Dr. Lima was previously Chief Operating Officer for Valor Resources Limited, an ASX-listed metals company focused on the development of the Berenguela Polymetallic Project in the Puno Department of Peru, and is currently COO and Director of Bifox Ltd. Dr. Lima holds an engineering degree from the University of the Republic in Montevideo, Uruguay, an MBA from ORT University in Montevideo, and a Doctorate in Management with a focus on mining projects from University of Phoenix, USA. Dr. Lima is a resident of Montevideo, Uruguay, and speaks fluent English, Portuguese, and native Spanish. Background information for Daura’s existing directors and officers may be found in the Company’s prospectus dated July 26, 2019, and available on www.sedar.com . Proposed Financing Pursuant to the terms of the LOI, Daura anticipates completing a financing of subscription receipts for minimum proceeds of $1,000,000 and maximum proceeds of $1,500,000 (the “Daura Financing”). The Company may retain a broker or pay finder’s fees to certain registrants or eligible persons exempt from registration on any portion of the Daura Financing. The net proceeds of the Daura Financing will be used: (a) to fund the business plan of the Resulting Issuer; (b) for Qualifying Transaction expenses; and (c) for general working capital purposes. Additional details regarding the Daura Financing will be provided in due course. About Estrella Gold S.A.C. Estrella is a private company incorporated under the laws of Peru. Estrella is focused on the acquisition, exploration, and development of precious metals properties in Peru. Estrella’s head office is located in Lima, Peru. Sponsorship of the Qualifying Transaction Sponsorship of a Qualifying Transaction of a capital pool company is required by the Exchange unless exempt in accordance with Exchange policies. Daura is currently reviewing the Exchange’s requirements for sponsorship to determine if it may seek a waiver of the sponsorship requirement. Additional Information In accordance with the policies of the Exchange, the Daura Shares are currently halted from trading and will remain halted until further notice. Daura and Estrella will provide further details in respect of the Qualifying Transaction, in due course once available, by way of press releases. All information provided in this press release related to Estrella has been provided by management of Estrella and has not been independently verified by management of Daura. If and when a definitive agreement between Daura and Estrella is executed, Daura will issue a subsequent press release in accordance with the policies of the Exchange containing details of the definitive agreement and additional terms of the Qualifying Transaction, including, but not limited to, information relating to Estrella’s properties, sponsorship, summary financial information in respect of Daura and Estrella, the names and backgrounds of all persons expected to be Principals and Insiders of the Resulting Issuer, and additional information with respect to the Daura Financing. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative. For further information please contact: Daura Capital Corp. 543 Granville, Suite 501 Vancouver BC V6C 1X8 William T.P. Tsang CFO and Secretary (604) 669-0660 btsang@seabordservices.com Mark D. Sumner CEO and Director mark@kiwandagroup.com NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions, and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: risks and uncertainties relating to Daura's ability to complete the proposed Qualifying Transaction; and other risks and uncertainties. In addition, mineralization on adjacent properties may not be indicative of the mineralization found on properties owned by the target of the proposed Qualifying Transaction. Accordingly, actual and future events, conditions, and results may differ materially from the estimates, beliefs, intentions, and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Daura undertakes no obligation to publicly update or revise forward-looking information. Completion of the transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange Requirements, majority of the minority shareholder approval. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative. The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

Stay Updated With Daura Gold.

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Sign up for our newsletter to receive news releases and exclusive company updates.